HIGHLIGHTS

OPERATING RESULTS

The Poste Italiane Group’s profit for 2016 amounts to €622 million, a 12.7% improvement on the figure for 2015, amounting to €552 million. Operating profit of €1,041 million is up 18.3% on the €880 million of 2015.

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

| for the year ended 31 December | Increase/(decrease) | |||

|---|---|---|---|---|

| (€m) | 2016 | 2015 | Amount | % |

| Revenue from sales and services and insurance premium revenue | 28,627 | 27,007 | 1,620 | 6.0% |

| Postal and Business Services | 3,768 | 3,818 | (50) | -1.3% |

| Financial Services | 4,683 | 4,707 | (24) | -0.5% |

| Insurance Services and Asset Management | 19,953 | 18,243 | 1,710 | 9.4% |

| Other Services | 223 | 239 | (16) | -6.7% |

| Other income from financial and insurance activities | 4,421 | 3,657 | 764 | 20.9% |

| Financial Services | 604 | 442 | 162 | 36.7% |

| Insurance Services and Asset Management | 3,817 | 3,215 | 602 | 18.7% |

| Other operating income | 64 | 75 | (11) | -14.7% |

| Postal and Business Services | 54 | 64 | (10) | -15.6% |

| Financial Services | 7 | 6 | 1 | 16.7% |

| Insurance Services and Asset Management | 2 | 1 | 1 | n/s |

| Other Services | 1 | 4 | (3) | -75.0% |

| Total revenue | 33,112 | 30,739 | 2,373 | 7.7% |

| Cost of goods and services | 2,476 | 2,590 | (114) | -4.4% |

| Net change in technical provisions for insurance business and other claims expenses | 21,958 | 19,683 | 2,275 | 11.6% |

| Other expenses from financial and insurance activities | 539 | 689 | (150) | -21.8% |

| Personnel expenses | 6,241 | 6,151 | 90 | 1.5% |

| Capitalised costs and expenses | (25) | (33) | 8 | 24.2% |

| Other operating costs | 301 | 198 | 103 | 52.0% |

| Total costs | 31,490 | 29,278 | 2,212 | 7.6% |

| EBITDA | 1,622 | 1,461 | 161 | 11.0% |

| Depreciation, amortisation and impairments | 581 | 581 | - | n/s |

| Operating profit/(loss) | 1,041 | 880 | 161 | 18.3% |

| Finance income/(costs) | 9 | 50 | (41) | -82.0% |

| Profit/(loss) on investments accounted for using the equity method | 6 | 3 | 3 | n/s |

| Profit/(Loss) before tax | 1,056 | 933 | 123 | 13.2% |

| Income tax expense | 434 | 381 | 53 | 13.9% |

| Profit for the year | 622 | 552 | 70 | 12.7% |

n/s: not significant

Despite the fact that the Postal and Business Services segment contributed a loss of €436 million, this is an improvement of 23.2% on the operating loss of €568 million for the previous year. This reflects the positive contribution from the fees paid by BancoPosta RFC in return for use of the Group’s distribution network.

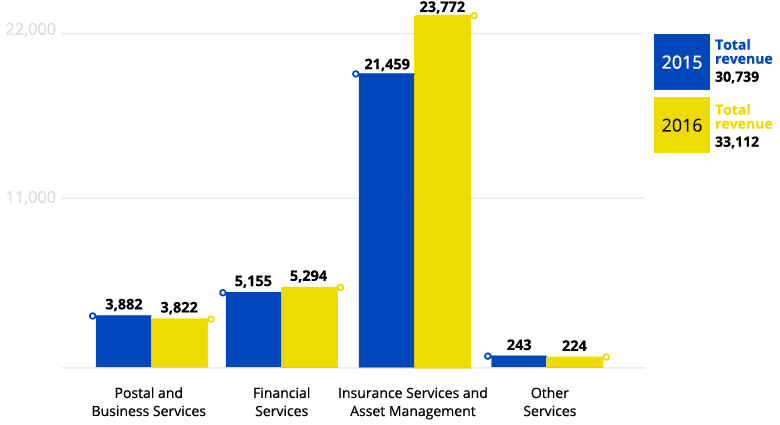

GROUP – TOTAL REVENUE BY OPERATING SEGMENT

(DATA IN MILLION EURO)

Total revenue of €33.1 billion is up 7.7% on 2015. The improvement primarily reflects the positive performance of insurance services and asset management, where total revenue amounts to €23.8 billion (up 10.8% compared with the previous year).

- Postal and Business Services: contributed total revenue of €3,822 million, registering a reduction of 1.5% due to the expected decline in traditional letter post. It should be noted that there has been an ongoing slowdown in the pace of decline in this segment’s total revenue over a number of quarters.

- Financial Services: total revenue amounts to €5,294 million, marking an increase of 2.7% due to a rise in “Other income from financial activities”, which is up from €442 million in 2015 to €604 million in 2016. This income includes €121 million in non-recurring income generated by the sale of the Group’s investment in Visa Europe Ltd..

- Insurance Services and Asset Management segment: from 1 January 2016, also includes the activities of BancoPosta Fondi Sgr, delivered excellent results during the year (€23.8 billion in total revenue), with Poste Vita and its subsidiary, Poste Assicura, recording premium revenue of €19.9 billion (premium revenue of €18.2 billion in 2015). This primarily reflects the performances of traditional Class I investment and savings products, where the Group has built up a strong presence.

- Other Services: total revenue amounts to €224 million (€243 million in 2015) and is generated by Poste Mobile.

FINANCIAL POSITION AND CASH FLOW

The Poste Italiane Group’s net invested capital at 31 December 2016 amounts to €1,909 million, amply financed by equity.

NET FUNDS

Total net funds at 31 December 2016 amount to €6,225 million, down on the figure for 31 December 2015 (when net funds amounted to €8,659 million).

| At 31 December 2016 (€m) | Postal and Business Services | Financial Services | Insurance Services and Asset Management | Other Services | Eliminations | Consolidated amount |

|---|---|---|---|---|---|---|

| Financial liabilities | (1,947) | (59,225) | (1,012) | (2) | 1,265 | (60,921) |

| Technical provisions for insurance business | - | - | (113,678) | - | - | (113,678) |

| Financial assets | 1,236 | 58,681 | 115,596 | 29 | (1,180) | 174,362 |

| Technical provisions for claims attributable to reinsurers | - | - | 66 | - | - | 66 |

| Net financial assets/(liabilities) | (711) | (544) | 972 | 27 | 85 | (171) |

| Cash and deposits attributable to BancoPosta | - | 2,494 | - | - | - | 2,494 |

| Cash and cash equivalents | 1,556 | 1,320 | 1,324 | 21 | (319) | 3,902 |

| Net funds/(debt) | 845 | 3,270 | 2,296 | 48 | (234) | 6,225 |

| At 31 December 2015 (€m) | Postal and Business Services | Financial Services | Insurance Services and Asset Management | Other Services | Eliminations | Consolidated amount |

|---|---|---|---|---|---|---|

| Financial liabilities | (2,442) | (55,418) | (1,218) | (4) | 1,604 | (57,478) |

| Technical provisions for insurance business | - | - | (100,314) | - | - | (100,314) |

| Financial assets | 1,396 | 57,574 | 102,409 | 26 | (1,315) | 160,090 |

| Technical provisions for claims attributable to reinsurers | - | - | 58 | - | - | 58 |

| Net financial assets/(liabilities) | (1,046) | 2,156 | 935 | 22 | 289 | 2,356 |

| Cash and deposits attributable to BancoPosta | - | 3,161 | - | - | - | 3,161 |

| Cash and cash equivalents | 1,315 | 485 | 1,615 | 16 | (289) | 3,142 |

| Net funds/(debt) | 269 | 5,802 | 2,550 | 38 | - | 8,659 |

FINANCIAL POSITION

A comparison with the end of the previous year, when the figure was €999 million, shows an increase of €910 million.

| at 31 December (€m) | 2016 | 2015 | Increase/ (decrease) | |

|---|---|---|---|---|

| Non-current assets: | ||||

| Property, plant and equipment | 2,080 | 2,190 | (110) | -5.0% |

| Investment property | 56 | 61 | (5) | -8.2% |

| Intangible assets | 513 | 545 | (32) | -5.9% |

| Investments accounted for using the equity method | 218 | 214 | 4 | 1.9% |

| Total non-current assets (a) | 2,867 | 3,010 | (143) | -4.8% |

| Working capital: | ||||

| Inventories | 137 | 134 | 3 | 2.2% |

| Trade receivables and other receivables and assets | 5,843 | 5,546 | 297 | 5.4% |

| Trade payables and other liabilities | (4,724) | (4,398) | (326) | 7.4% |

| Current tax assets and liabilities | (73) | 19 | (92) | n/s |

| Total working capital: (b) | 1,183 | 1,301 | (118) | -9.1% |

| Gross invested capital (a+b) | 4,050 | 4,311 | (261) | -6.1% |

| Provisions for risks and charges | (1,507) | (1,397) | (110) | 7.9% |

| Provisions for employee termination benefits and pension plans | (1,347) | (1,361) | 14 | -1.0% |

| Deferred tax assets/(liabilities) | 53 | (554) | 607 | n/s |

| Non-current assets and disposal groups held for sale and liabilities related to assets held for sale (1) | 660 | - | 660 | n/s |

| Net invested capital | 1,909 | 999 | 910 | 91.1% |

| Equity | 8,134 | 9,658 | (1,524) | -15.8% |

| Net funds | 6,225 | 8,659 | (2,434) | -28.1% |

(1) Non-current assets and disposal groups amount to €2,720 million and regard BdM-MCC SpA, totalling €2,665 million, and BancoPosta Fondi SpA

SGR, totalling €55 million. Liabilities related to assets held for sale amount to €2,060 million and regard BdM-MCC SpA, totalling €2,049 million,

and BancoPosta Fondi SpA SGR, totalling € 11 million.

n/s: not significant

AREAS OF BUSINESS

The Group’s operations are divided into four operating segments: Postal and Business Services, Financial Services, Insurance Services and Asset Management, and Other Services, which are managed by dedicated Group functions and/or companies.

The organisation is also based on two distribution channels for retail customers, on the one hand, and business and Public Administration customers, on the other. These channels operate alongside a series of corporate functions responsible for policy, governance, controls and the provision of services supporting business processes.

The organisational model, which ensures the development of synergies within the Group as part of an integrated approach to operations, is applied via governance and operating models, characterised by:

- coherent and integrated management of the Group, ensuring a uniform and coordinated approach to the market, whilst taking into account the central importance of customers and exploiting potential synergies, as well as assigning responsibility for coordinating subsidiaries to the relevant functions within the Parent Company according to business sector;

- an organisational structure focused on core businesses: mail and logistics, payments and financial services, savings and insurance;

- Corporate functions capable of ensuring, through coordination and integration of their respective areas of expertise, coherent fulfilment of their assigned roles at Group level and the provision of shared services closely aligned with business needs, thus ensuring efficiency, economies of scale, quality and effective support for the different businesses.