HIGHLIGHTS

OPERATING RESULTS

During a year in which the economic environment remained challenging, the overall results of the Poste Italiane Group and its Parent Company reflect positive performances from financial and insurance services, offset by a further decline in traditional postal services, which recorded a progressive reduction in revenue, weighing heavily on the results for the year.

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

| Increase/(decrease) | Year ended 31 December | |||

|---|---|---|---|---|

| (€m) | % | Amount | 2013 | 2014 |

| Revenue from sales and services | (4.9) | (472) | 9,622 | 9,150 |

| Insurance premium revenue | 17.2 | 2,272 | 13,200 | 15,472 |

| Other income from financial and insurance activities | 15.0 | 491 | 3,281 | 3,772 |

| Other operating income | (28.5) | (47) | 165 | 118 |

| Total revenue | 8.5 | 2,244 | 26,268 | 28,512 |

| Cost of goods and services | (3.1) | (86) | 2,734 | 2,648 |

| Net change in technical provisions for insurance business and other claims expenses | 17.1 | 2,617 | 15,266 | 17,883 |

| Other expenses from financial and insurance activities | 2.7 | 2 | 74 | 76 |

| Personnel expenses | 3.7 | 221 | 6,008 | 6,229 |

| Depreciation, amortisation and impairments | 13.9 | 82 | 589 | 671 |

| Capitalised costs and expenses | (47.4) | 27 | (57) | (30) |

| Other operating costs | 35.4 | 90 | 254 | 344 |

| Total ope rating costs | 11.9 | 2,953 | 24,868 | 27, 821 |

| OPERATING PROFIT/(LOSS) | (50.6) | (709) | 1,400 | 691 |

| Finance income | (12.4) | (28) | 226 | 198 |

| Finance costs | 94.9 | 93 | 98 | 191 |

| Profit/(loss) on investments accounted for using the equity method | n/s | (1) | - | (1) |

| PROFIT/(LOSS) BEFORE TAX | (54.4) | (831) | 1,528 | 697 |

| Income tax expense | (35.0) | (261) | 746 | 485 |

| Income tax for previous years following change in legislation | n/s | 223 | (223) | - |

| PROFIT FOR THE YEAR | (78.9) | (793) | 1,005 | 212 |

n/a: not applicable

n/s: not significant

In particular, the Group’s operating profit amounts to €691 million (€1,400 million for 2013), whilst the Parent Company reports a figure of €381million (€917 million for the previous year), reflecting, as already noted, the decline in revenue from Postal and Business services, which is down from the €4,452 million of 2013 to €4,074 million in 2014.

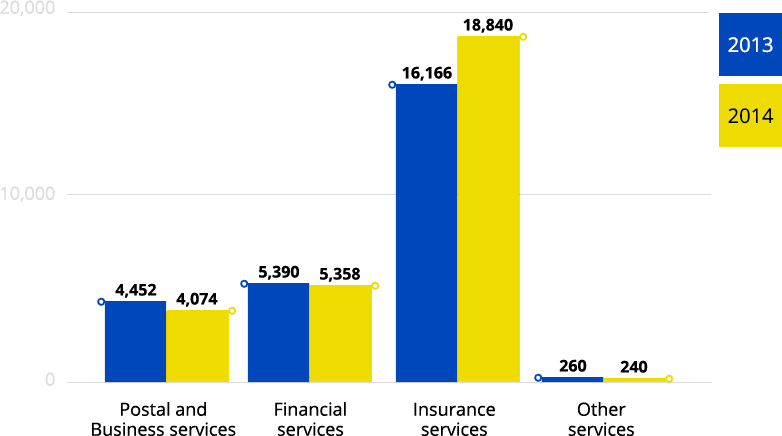

GROUP – TOTAL REVENUE BY OPERATING SEGMENT (DATA IN MILLION EURO)

Group’s total revenue of €28,512 million (€26,268 million in 2013) benefitted from the positive contribution from Poste Vita’s premium revenue.

- Postal and Business services: total revenue is down 8.5% (a reduction of €378 million) and continues to suffer from the crisis in traditional forms of communication, reflecting the growing popularity of digital technologies, and the general reduction in demand for products and services, exacerbated by tough price competition.

- Financial services: total revenue, amounting to €5,358 million, is in line with the previous year (down 0.6% on 2013), having benefitted from the positive performance of other income from financial activities.

- Insurance services: the Insurance services provided by the Poste Vita Group have contributed €18,840 million to total revenue, marking growth of 16.5% on the €16,166 million of the previous year.

- Other services: total revenue amounts to €240 million (€260 million in the previous year) and regards the revenue generated by the mobile telecommunications services provided by PosteMobile SpA and Consorzio per I servizi di telefonia Mobile ScpA.

FINANCIAL POSITION AND CASH FLOW

The Poste Italiane Group’s net invested capital amounts to €3,677 million (€3,859 million at 31 December 2013), 100% financed by equity.

NET INVESTED CAPITAL

In addition to movements in non-current assets and working capital, the reduction in net invested capital at 31 December 2014 reflects:

- a reduction of €513 million in the net balance of deferred tax assets/(liabilities), primarily due to the increase in the fair value reserve for BancoPosta’s investments in securities, which generated an increase in deferred tax liabilities;

- an increase of €168 million in provisions for risks and charges, primarily due to the effect of the expected liabilities for restructuring costs.

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Non-current assets | 3,145 | 2,893 | (252) |

| Working capital | 3,052 | 3,941 | 889 |

| Provisions for risks and charges | (1,166) | (1,334) | (168) |

| Employee termination benefits and pension plans | (1,340) | (1,478) | (138) |

| Deferred tax assets/(liabilities) | 168 | (345) | (513) |

| Net invested capital | 3,859 | 3,677 | (182) |

NET FUNDS

Net funds at 31 December 2014 amount to €4,741 million (net funds of €3,257 million at the end of 2013), reflecting:

- the results of the fair value measurement of investments in available-for-sale financial assets (approximately €2,650 million);

- cash subject to restrictions, as shown in the following table, as attributable to technical provisions for the insurance business or subject to investment restrictions (BancoPosta RFC);

- net financial assets held by Poste Vita and Banca del Mezzogiorno-MedioCredito Centrale, which are subject to supervisory capital requirements (approximately €1,900 million).

| at 31 December (€m) | 2013 | 2014 |

|---|---|---|

| Financial liabilities | 51,770 | 55,358 |

| Technical provisions for insurance business | 68,005 | 87,219 |

| Financial assets | (118,467) | (142,687) |

| Technical provisions for claims attributable to reinsurers | (40) | (54) |

| Net financial liabilities/(assets) | 1,268 | (164) |

| Cash and deposits attributable to BancoPosta | (3,080) | (2,873) |

| Cash and cash equivalents | (1,445) | (1,704) |

| of which: | ||

| - Adjusted cash and cash equivalents | (559) | (778) |

| - Cash subject to investment restrictions | (262) | (511) |

| - Cash attributable to technical provisions for insurance business | (624) | (415) |

| Net debt/(funds) | (3,257) | (4,741) |

AREAS OF BUSINESS

- FINANCIAL SERVICES

- INSURANCE SERVICES

- POSTAL AND BUSINESS SERVICES

- OTHER SERVICES

The Financial services segment includes current accounts, payment services, financial products and third-party loan products. These operations were transferred from Poste Italiane SpA to BancoPosta.

- BANCOPOSTA RFC

During 2014, BancoPosta RFC's commercial offering was focused on cross-selling and attracting new current account deposits. In the private current account segment, the Conto BancoPosta Più offering has been expanded through the introduction of new promotions: customers purchasing a Postaprotezione SiCura and/or a Postaprotezione Infortuni insurance policy or purchasing PosteMobile products have had their annual current account fee cut to zero.

The Conto BancoPosta In Proprio offering for SMEs was restyled. Customers who retain a minimum balance on their account each month and purchase or use a certain number of products (collection and payment or loans and insurance) receive a reduction in their account charges.

A number of initiatives have also been taken to attract new deposits and consolidate the market positioning of online current accounts.- Revenue generated by BancoPosta RFC’s financial services is down from the €5,326 million of 2013 to €5,228 million in 2014 (a decline of 1.8%).

- BANCA DEL MEZZOGIORNO - MEDIOCREDITO CENTRALE SPA

During 2014 Banca del Mezzogiorno-MedioCredito Centrale (MCC) continued to provide support for creditworthy companies operating in southern Italy, through its lending activities and by promoting and facilitating access to government subsidies.- In 2014 the bank reported net income from banking activities of €100.6 million (€64.2 million in 2013) and net interest income of €43.7 million (€21.1 million in 2013).

- Total loans and advances amount to €1.3 billion at the end of 2014, compared with the €771 million registered at the end of 2013.

- Net fees are also up (€41.1 million in 2014, compared with the €35.4 million in the previous year), primarily generated by management of the Fondo Centrale di Garanzia per le PMI (central guarantee fund for SMEs).

- Net profit for 2014 amounts to €37.6 million (€11.6 million in 2013).

- BANCOPOSTA FONDI SPA SGR

BancoPosta Fondi SpA SGR continued to carry out activities regarding Collective Investment Undertakings – UCIs and the Individual Investment Portfolio service in 2014.- Total assets under management in relation to the company's lines of business (individual and collective investment services) amount to €62.2 billion at 31 December 2014 (up €16.3 billion or 36% on the end of 2013).

- The company reports a profit of €14 million for the year (€11 million in 2013).

POSTE VITA INSURANCE GROUP

In continuation of strategic objectives pursued in previous years, in 2014 the Poste Vita Insurance Group primarily focused its efforts on:

- consolidating and strengthening the Poste Vita Parent Company's position in the life insurance and pensions market, with a particular focus on the supplementary pension segment and new emerging needs (primarily welfare and longevity);

- growing the non-life insurance business, with a view to positioning the subsidiary, Poste Assicura, as a leading player in this market.

Thanks partly to a constant focus on products, stepping up support to the distribution network and growing customer loyalty, the company’s efforts concentrated almost exclusively on the offer of Branch I investment and savings products (traditional separately managed accounts) with inflows of around €14.7 billion (€13 billion in 2013), while a marginal contribution was made by the sale of Branch III products (€17 million in 2014, compared with €79 million in 2013).

Total premium revenue amounts to €15.4 billion (€13.2 billion of insurance premiums in 2013).

- MAIL AND PHILATELY

The initiatives implemented in 2014 were aimed at strengthening customer relations and enhancing the business model, adding to logistics and technology platforms and introducing innovative solutions to better respond to market demand.- the results for mail and philately services in 2014 reveal reductions in both volumes and revenue of 10.4% (431 million fewer items handled) and 11.4% (a decrease in revenue of €351 million), respectively, compared with 2013.

- market revenue of €2,713 million is down 10.3%, representing a reduction of €312 million compared with 2013.

- EXPRESS DELIVERY AND PARCELS

One of the segments the Company is focusing on is e-commerce, which is substantially influencing the Express Delivery and Parcels sector.

In 2014 the Group focused on activities aimed at further expanding the range of options on offer to customers, leveraging the widespread nature of the postal network so as to ensure that e-commerce products are increasingly flexible and complete, and to strengthen the ancillary services of key importance to the principal operators in the sector.- Poste Italiane SpA’s express delivery volumes were up 46.2% and revenue was up 15.1% on 2013 on the back of B2C and e-commerce expansion

- SDA Express Courier SpA records growth in volumes and revenues, 12.8% and 6.1%, respectively, compared with 2013 (deliveries up 6.9 million, and revenue up €22.8 million)

- Universal Parcels Service revenue of €38.4 million (€34.8 million in 2013) reflects the positive performances of Domestic Parcels (up 14.5% in volume terms and 12% in terms of revenue) and International Outbound Parcels (up 2.7% in volume terms and 10.5% in terms of revenue compared with 2013)

- DIGITAL AND MULTI-CHANNEL SERVICES

The development and supply of the Hybrid Communication offering continued during 2014. This enable registered letters, telegrams, priority mail and e-commerce services to be provided online. In this regard, Poste Italiane’s e-commerce offering was expanded during the year, with the supply of web marketing services for the online promotion of merchants.

POSTEMOBILE

In 2014 PosteMobile continued to focus its efforts on maintaining and strengthening its “value” proposition, developing initiatives designed to acquire higher value customers, thereby consolidating the quality of acquisitions and increasing the customer base. As a result, the number of lines reached 3.3 million at the end of December 2014 (2.8 million lines at the end of 2013).

- revenues from sales and services, amounting to €321.5 million in 2014, marks a slight increase on the €321.1 million recorded in 2013.

- Despite a reduction in the cost of goods and services, which amount to €233.9 million (€247.0 million in 2013), operating profit reflects higher depreciation and amortisation, primarily due to the Full MVNO platform (up €12.6 million in 2014), and provisions (up €3.5 million). As a result, operating profit is €13.7 million (€25.4 million in 2013).

- The company reports a profit for the year of €7.8 million (€15.8 million for 2013).