OPERATING RESULTS

The consolidated statement of profit or loss is shown below.

Poste Italiane Group

| Increase/(decrease) | Year ended 31 December | |||

|---|---|---|---|---|

| (€m) | % | Amount | 2013 | 2014 |

| Revenue from sales and services | (4.9) | (472) | 9,622 | 9,150 |

| Insurance premium revenue | 17.2 | 2,272 | 13,200 | 15,472 |

| Other income from financial and insurance activities | 15.0 | 491 | 3,281 | 3,772 |

| Other operating income | (28.5) | (47) | 165 | 118 |

| Total revenue | 8.5 | 2,244 | 26,268 | 28,512 |

| Cost of goods and services | (3.1) | (86) | 2,734 | 2,648 |

| Net change in technical provisions for insurance business and other claims expenses | 17.1 | 2,617 | 15,266 | 17,883 |

| Other expenses from financial and insurance activities | 2.7 | 2 | 74 | 76 |

| Personnel expenses | 3.7 | 221 | 6,008 | 6,229 |

| Depreciation, amortisation and impairments | 13.9 | 82 | 589 | 671 |

| Capitalised costs and expenses | (47.4) | 27 | (57) | (30) |

| Other operating costs | 35.4 | 90 | 254 | 344 |

| Total ope rating costs | 11.9 | 2,953 | 24,868 | 27, 821 |

| OPERATING PROFIT/(LOSS) | (50.6) | (709) | 1,400 | 691 |

| Finance income | (12.4) | (28) | 226 | 198 |

| Finance costs | 94.9 | 93 | 98 | 191 |

| Profit/(loss) on investments accounted for using the equity method | n/s | (1) | - | (1) |

| PROFIT/(LOSS) BEFORE TAX | (54.4) | (831) | 1,528 | 697 |

| Income tax expense | (35.0) | (261) | 746 | 485 |

| Income tax for previous years following change in legislation | n/s | 223 | (223) | - |

| PROFIT FOR THE YEAR | (78.9) | (793) | 1,005 | 212 |

n/a: not applicable

n/s: not significant

During a year in which the economic environment remained challenging, the overall results of the Poste Italiane Group and its Parent Company reflect positive performances from financial and insurance services, offset by a further decline in traditional postal services, which recorded a progressive reduction in revenue, weighing heavily on the results for the year. In particular, the Group’s operating profit amounts to €691 million (€1,400 million for 2013), whilst the Parent Company reports a figure of €381million (€917 million for the previous year), reflecting, as already noted, the decline in revenue from Postal and Business services, which is down from the €4,452 million of 2013 to €4,074 million in 2014. As the reader will be aware, the fact that variable costs have limited impact on the operating performance and that the Company’s cost structure is primarily made up of personnel expenses has a significant impact on margins. In fact, Postal and Business services contributed a loss of €504 million to the consolidated operating result, compared with a profit of €300 million in the previous year.

It should also be noted in relation to this segment, which benefits from intersegment revenue generated on transactions with BancoPosta RFC, that the Parent Company’s postal operations report an operating loss of €1,154 million, after a partial recovery of its Universal Service costs, as calculated under the regulatory accounting model. This result marks a deterioration with respect to 2013, when the operating loss was €575 million.

Revenue from Financial services is in line with the figure for 2013 (€5,358 million in 2014, €5,390 million in 2013), whilst the contribution to operating profit is up 15.5% (€766 million in 2014, compared with €663 million for 2013).

Poste Vita made a significant contribution, reporting an excellent operating performance for the period (€15.4 billion in premium revenue, up 17%), enabling the company to consolidate its growth.

OPERATING RESULTS OF THE POSTE ITALIANE GROUP

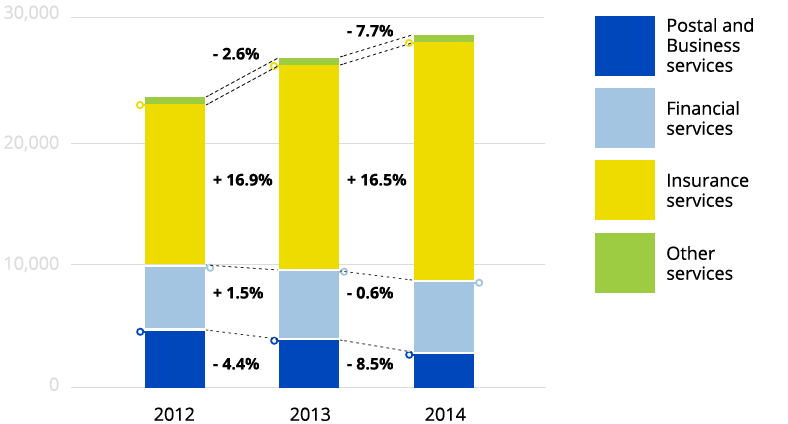

Revenue by operating segment ⁽*⁾

| Total revenue | Increase/(decrease) | |||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Postal and Business Services | 4,452 | 4,074 | (378) | (8.5) |

| Financial Services | 5,390 | 5,358 | (32) | (0.6) |

| Insurance Services | 16,166 | 18,840 | 2,674 | 16.5 |

| Other Services | 260 | 240 | (20) | (7.7) |

| Total Poste Italiane Group | 26,268 | 28,512 | 2,244 | 8.5 |

(*) After consolidation adjustments and elimination of intercompany transactions.

Group - Total revenue

| Revenues from sales and services | % | Insurance premium revenue | % | Other income from financial and insurance activities | % | Other operating income | % | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | inc./ (dec.) | 2013 | 2014 | inc./ (dec.) | 2013 | 2014 | inc./ (dec.) | 2013 | 2014 | inc./ (dec.) |

| Postal and Business Services | 4,309 | 3,964 | (8.0) | - | - | - | - | - | - | 143 | 110 | (23.1) |

| Financial Services | 5,068 | 4,950 | (2.3) | - | - | - | 315 | 404 | 28.3 | 7 | 4 | (42.9) |

| Insurance Services | - | - | - | 13,200 | 15,472 | 17.2 | 2,966 | 3,368 | 13.6 | - | - | - |

| Other Services | 245 | 236 | (3.7) | - | - | - | - | - | - | 15 | 4 | (73.3) |

| Total Poste Italiane Group | 9,622 | 9,150 | (4.9) | 13,200 | 15,472 | 17.2 | 3,281 | 3,772 | 15.0 | 165 | 118 | (28.5) |

The Group’s Postal and Business services

| Total revenue for the year ended 31 December | Increase/ (decrease) | |||||

|---|---|---|---|---|---|---|

| (€m) | 2013 | 2014 | Amount | % | ||

| Poste Italiane SpA(*) | 3,793 | 3,545 | ||||

| of which: intercompany revenue | 59 | 279 | ||||

| Poste Italiane SpA - external revenue | 3,734 | 3,266 | (468) | (12.5) | ||

| SDA Express Courier SpA | 477 | 511 | ||||

| of which: intercompany revenue | 105 | 116 | ||||

| SDA Express Courier SpA - external revenue | 372 | 395 | 23 | 6.1 | ||

| Gruppo Postel | 354 | 318 | ||||

| of which: intercompany revenue | 186 | 171 | ||||

| Gruppo Postel - external revenue | 168 | 147 | (21) | (12.5) | ||

| Italia Logistica Srl | 67 | 69 | ||||

| of which: intercompany revenue | 29 | 33 | ||||

| Italia Logistica Srl - external revenue | 38 | 36 | (2) | (5.3) | ||

| Mistral Air Srl | 103 | 131 | ||||

| of which: intercompany revenue | 36 | 36 | ||||

| Mistral Air Srl - external revenue | 67 | 95 | 28 | 41.8 | ||

| PosteShop SpA | 29 | 23 | ||||

| of which: intercompany revenue | 1 | 1 | ||||

| PosteShop SpA - external revenue | 28 | 22 | (6) | (21.4) | ||

| Postecom SpA | 117 | 91 | ||||

| of which: intercompany revenue | 99 | 82 | ||||

| Postecom SpA - external revenue | 18 | 9 | (9) | (50.0) | ||

| Altre società | 355 | 444 | ||||

| of which: intercompany revenue | 328 | 340 | ||||

| Other companies - external revenue | 27 | 104 | 77 | n/s | ||

| Total external revenue | 4,452 | 4,074 | (378) | (8.5) | ||

n/s: not significant

(*) This item includes Postal services revenue, other revenue from the sale of goods and services and other operating income. It does not take into account the portion attributable to BancoPosta RFC.

As noted above, the Group’s total revenue of €28,512 million (€26,268 million in 2013) benefitted from the positive contribution from Poste Vita’s premium revenue.

Taking a closer look, total revenue from Postal and Business services is down 8.5% (a reduction of €378 million) and continues to suffer from the crisis in traditional forms of communication, reflecting the growing popularity of digital technologies, and the general reduction in demand for products and services, exacerbated by tough price competition.

Total revenue from Financial services, amounting to €5,358 million, is in line with the previous year (down 0.6% on 2013), having benefitted from the positive performance of other income from financial activities, which is up from the €315 million of 2013 to €404 million in 2014. This category of revenue includes income from investments in fixed income Italian government securities, purchased with the aim of anticipating renewal of BancoPosta’s investments close to maturity.

The Insurance services provided by the Poste Vita Group have contributed €18,840 million to total revenue, marking growth of 16.5% on the €16,166 million of the previous year.

Total revenue from Other services amounts to €240 million (€260 million in the previous year) and regards the revenue generated by the mobile telecommunications services provided by PosteMobile SpA and Consorzio per i servizi di telefonia Mobile ScpA.

COST ANALYSIS

| for the year ended 31 December (€m) | 2013 | 2014 | % inc./ (dec.) |

|---|---|---|---|

| Cost of goods and services | 2,734 | 2,648 | (3.1) |

| Net change in technical provisions for insurance business and other claims expenses | 15,266 | 17,883 | 17.1 |

| Other expenses from financial and insurance activities | 74 | 76 | 2.7 |

| Personnel expenses | 6,008 | 6,229 | 3.7 |

| Depreciation, amortisation and impairments | 589 | 671 | 13.9 |

| Capitalised costs and expenses | (57) | (30) | (47.4) |

| Other operating costs | 254 | 344 | 35.4 |

| Total operating costs | 24,868 | 27,821 | 11.9 |

The cost of goods and services is down 3.1% from €2,734 million in 2013 to €2,648 million in 2014, reflecting a reduction in the cost of funding, represented by interest paid to private customers by BancoPosta RFC and the interest payable to major financial institutions acting as counterparties in repurchase agreements.

The increase in technical provisions for the insurance business and other claims expenses, which is closely linked to the above growth in premium revenue recorded by Poste Vita, amounts to €17,883 million and is up 17.1% on the previous year.

Other expenses from financial and insurance activities of €76 million is in line with the previous year (€74 million in 2013).

Personnel costs

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Salaries, social security contributions and sundry expenses(*) | 5,906 | 5,832 | (74) | (1.3) |

| Redundancy payments | 53 | 152 | 99 | n/s |

| Net provisions (uses) for disputes | (45) | (11) | 34 | (75.6) |

| Provisions for restructuring charges | 114 | 256 | 142 | n/s |

| Total | 6,028 | 6,229 | 201 | 3.3 |

| Income from fixed-term and temporary contract agreements | (20) | - | 20 | n/s |

| Total personnel expenses | 6,008 | 6,229 | 221 | 3.7 |

(*) This includes the following items described in note C8 to the consolidated financial statements: salaries and wages; social security contributions; employee termination benefits; temporary work; Directors’ fees and expenses; other costs (cost recoveries).

Ordinary personnel expenses, linked to salaries, contributions and sundry expenses, are down 1.3% (a reduction of €74 million) on 2013, reflecting a decrease in the average workforce employed during the year (approximately 800 fewer Full-Time Equivalent staff employed on average in 2014, compared with the previous year) and a reduction in costs compared with 2013, when the figure was influenced by additional pay caused by 3 public holidays falling on a Sunday. The reduction also reflects payments relating to renewal of the national collective contract and payment, in 2013, of a bonus based on the achievement of certain operating results by the Group, in accordance with specific union agreements.

Personnel expenses also reflect an increase in redundancy payments, which are up from €53 million in 2013 to €152 million in 2014, and provisions for restructuring charges of €256 million (provisions of €114 million in 2013), made to cover the estimated costs to be incurred by the Parent Company for early retirement incentives, under the current redundancy scheme for employees leaving the Company by 31 December 2016.

Finally, the change in personnel expenses also reflects income of €20 million recognised by the Parent Company in 2013, following the agreements of March 2013 between the Parent Company and the labour unions, regarding the re-employment by court order of staff previously employed on fixed-term contracts.

Total personnel expenses are thus up 3.7% from the €6,008 million of 2013 to €6,229 million in 2014.

The above movements in revenue and costs have resulted in operating profit of €691 million (€1,400 million in 2013), as shown in the following table.

OPERATING PROFIT: BY OPERATING SEGMENT

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Postal and Business Services | 300 | (504) | (804) | n/s |

| Financial Services | 663 | 766 | 103 | 15.5 |

| Insurance Services | 411 | 415 | 4 | 1.0 |

| Other Services | 25 | 14 | (11) | (44.0) |

| Elimination(*) | 1 | - | (1) | n/s |

| Total Poste Italiane Group | 1,400 | 691 | (709) | (50.6) |

(*) Elimination of costs incurred by Poste Italiane SpA for interest paid to consolidated subsidiaries (recognised by the latter in finance income)

Net finance income of €6 million (€128 million in 2013) reflects, among other things, the impairment loss recognised on the investment in Alitalia-CAI SpA (€75 million).

Income tax expense is down from €746 million in 2013 to €485 million in 2014.

The effective tax rate for 2014 is 69.58%, consisting of the sum of the IRES tax rate (34.69%) and the IRAP tax rate (34.89%). Compared with the figure for 2013, when the effective tax rate was 34.26%, it should be noted that the previous year benefitted from the positive impact of recognition of an IRES refund for the years from 2004 to 2006, in accordance with Law Decree 201 of 6 December 2011 (resulting in a reduction in the tax rate of 14.57%). In addition, the rate for 2014 reflects the greater impact of the non-deductibility of personnel expenses for the purposes of IRAP, due to the fact that profit before tax is lower than for the previous year.

Profit for the year ended 31 December 2014 thus amounts to €212 million (€1,005 million for 2013).

OPERATING RESULTS OF POSTE ITALIANE SPA

Revenue

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Mail and Philately | 3.025 | 2.713 | (312) | (10.3) |

| Express Delivery and Parcels | 123 | 140 | 17 | 13.8 |

| Total market revenue from Postal services(*) | 3.148 | 2.853 | (295) | (9.4) |

| BancoPosta services | 5.326 | 5.228 | (98) | (1.8) |

| Other revenue | 105 | 96 | (9) | (8.6) |

| Market revenue | 8.579 | 8.177 | (402) | (4.7) |

| Universal Service Obligation (USO) compensation(*) | 343 | 277 | (66) | (19.2) |

| Electoral subsidies(*) | 56 | 17 | (39) | (69.6) |

| Total revenue from sales and services | 8.978 | 8.471 | (507) | (5.6) |

| Other income from financial activities | 308 | 389 | 81 | 26.3 |

| Other operating income | 147 | 306 | 159 | n/s |

| Total revenue attributable to Poste Italiane SpA | 9.433 | 9.166 | (267) | (2.8) |

| (*) Market revenue from Postal Services | 3.148 | 2.853 | ||

| USO compensation | 343 | 277 | ||

| Electoral subsidies(**) | 56 | 17 | ||

| Total Postal services | 3.547 | 3.147 | (400) | (11.3) |

(**) Subsidies for tariffs discounted in accordance with the law.

n/s: not significant

Poste Italiane SpA’s revenue from sales and services amounts to €8,471 million for 2014, down 5.6% on the figure for 2013 (revenue of €8,978 million in the previous year). As noted in the review of the Group’s results, this performance is due to the downturn in revenue from postal and business services market, reflecting a decline in demand for traditional mail services, above all from major customers due to both e-substitution, where electronic forms of communication replace paper forms (individual letters replaced by e-mails, bank statements and bills made available on line, etc.), and a tendency among companies to reduce their dependence on business post in order to cut their operating costs.

As a result, market revenue from mail and philately services is down 10.3% on 2013 (a reduction of €312 million), reflecting a 10.4% reduction in volumes (431 million fewer items sent in 2014, compared with 2013). This is primarily due to the negative performances registered by Unrecorded Mail (volumes down 14.5% and revenue down 14.6%), Recorded Mail (volumes down 6.7% and revenue down 8.1%) and Direct Marketing (volumes down 5.8% and revenue down 6.7% on the previous year), the latter market having been hard hit by the economic downturn of recent years. The performance of the postal services segment also reflects growing use of digital forms of communication between government agencies and the public.

The only area showing any signs of growth is the Express Delivery and Parcels segment, where revenue is up 13.8% from the €123 million of 2013 to €140 million in 2014, thanks to the Company’s commitment to developing its e-Commerce offering.

The compensation partially covering the cost of the universal service for 2014 has been determined taking into account the limits represented by the amount earmarked for this purpose in the Government’s budget, contained in art.1, paragraph 274 of Law 190 of 23 December 2014 – Provisions concerning development of the Annual and Multi-year Budget (the 2015 Stability Law). The cost incurred by Poste Italiane SpA was calculated using the new “net avoided cost” method, introduced by EU Directive 2008/6/EC and transposed into Italian law by Legislative Decree 58 of 31 March 2011(1). The compensation, amounting to €277 million, is in any event significantly lower than the actual costs incurred, as calculated by the Company.

Market revenue from BancoPosta services amounts to €5,228 million (€5,326 million in 2013), marking a slight decline (down 1.8%) due to both a reduction in the return on the mandatory deposit of the current account deposits of Public Sector customers with the Ministry of the Economy and Finance (the rate of interest received has fallen from the 2.61% of 31 December 2013 to 1.34% at 31 December 2014), and a reduction in fees generated by the processing of bills paid by payment slip, reflecting a decline in the number of payment slips handled.

Other income from the sale of goods and services, not specifically attributable to postal or financial activities, amounts to €96 million (€105 million in 2013).

Other income from financial activities is up from €308 million in 2013 to €389 million in 2014, essentially reflecting the gain realised on the sale of financial assets attributable to BancoPosta RFC.

Finally, other operating income contributed €306 million (€147 million in the previous year) to total revenue (€9,166 million in 2014, compared with €9,433 million in 2013), including €201 million in dividends from subsidiaries.

COST ANALYSIS

| for the year ended 31 December (€m) | 2013 | 2014 | % inc./ (dec.) |

|---|---|---|---|

| Cost of goods and services | 2,025 | 1,921 | (5.1) |

| Other expenses from financial activities | 7 | 6 | (14.3) |

| Personnel expenses | 5,755 | 5,972 | 3.8 |

| Depreciation, amortisation and impairments | 501 | 578 | 15.4 |

| Capitalised costs and expenses | (5) | (6) | 20.0 |

| Other operating costs | 233 | 314 | 34.8 |

| Total operating costs | 8,516 | 8,785 | 3.2 |

Operating costs incurred in 2014 are up 3.2% (an increase of €269 million on 2013), primarily due to personnel expenses, as described below.

A closer look shows that the cost of goods and services is down €104 million (5.1%), due primarily to a reduction in interest expense (down €102 million on 2013) paid to BancoPosta’s private customers and to major financial institutions acting as counterparties in repurchase agreements.

Depreciation, amortisation and impairments, which have risen from €501 million in 2013 to €578 million in 2014, include impairment losses primarily on industrial buildings owned by the Company (buildings used in operations) and commercial buildings leased by the Company (leasehold improvements). These impairments have been recognised following a prudent assessment of the impact on their value in use, should the future use of such assets in operations be reduced or halted.

Other operating costs are up from €233 million in 2013 to €314 million in 2014, reflecting, among other things, an increase in provisions linked to the procedures and timing involved in the collection of amounts receivable from the parent.

Personnel expenses break down as follows.

Personnel expenses

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Salaries, social security contributions and sundry expenses(*) | 5,655 | 5,571 | (84) | (1.5) |

| Redundancy payments | 53 | 151 | 98 | n/s |

| Net provisions for disputes | (47) | (6) | 41 | (87.2) |

| Provisions for restructuring charges | 114 | 256 | 142 | n/s |

| Total | 5,775 | 5,972 | 197 | 3.4 |

| Income from fixed-term and temporary contract agreements | (20) | - | 20 | n/s |

| Total personnel expenses | 5,755 | 5,972 | 217 | 3.8 |

(*) This includes the following items: salaries and wages; social security contributions; employee termination benefits; temporary work; Directors’ fees and expenses; other costs (cost recoveries).

Ordinary personnel expenses, linked to salaries, contributions and sundry expenses, which are down 1.5% (a reduction of €84 million) on 2013, reflecting a decrease in the average workforce employed during the year (more than 900 fewer Full-Time Equivalent staff employed on average in 2014) and a reduction in costs compared with 2013, when the figure was influenced by additional pay caused by 3 public holidays falling on a Sunday. The reduction also reflects payments relating to renewal of the national collective contract and payment, in 2013, of a bonus based on the achievement of certain operating results by the Group, in accordance with specific union agreements.

Personnel expenses also reflect an increase in redundancy payments, which are up from €53 million in 2013 to €151 million in 2014, and provisions for restructuring charges of €256 million (provisions of €114 million in 2013), made to cover the estimated costs to be incurred by the Company for early retirement incentives, under the current redundancy scheme for employees leaving the Company by 31 December 2016.

Personnel expenses also benefit from net releases of €6 million from provisions for disputes (net releases of €47 million in 2013), reflecting updated estimates of the liabilities and related legal expenses, based on both the overall level of claims actually paid and application of the so-called Collegato lavoro legislation, which has introduced a cap on compensation payable on current and future claims brought by workers on fixed-term contracts, who have been reemployed on permanent contracts by court order.

Finally, the change in personnel expenses also reflects income of €20 million recognised by Poste Italiane in 2013, following the agreements of March 2013 between the Company and the labour unions, regarding the reemployment by court order of staff previously employed on fixed-term contracts.

Again with regard to fixed-term contracts, the Company employed 8,052 people on fixed-term contracts in 2014 (8,149 in 2013), equal to 7,743 FTEs (7,946 FTEs in 2013). As a result of specific measures establishing quotas limiting the use of such contracts, the following should be noted: the permanent workforce at 1 January 20142 totalled 143,422 (144,087 at 1 January 2013), equal to 137,983 FTEs (138,877 FTEs at 1 January 2013); the number of people on fixed-term contracts as defined by art. 2, paragraph 1-bis of Legislative Decree 368/013 – the so-called “causale finanziaria” – amounted to 2,388, equal to 2,345 FTEs; the number of people on fixed-term contracts as defined by art. 1, paragraph 1 of Legislative Decree 368/01, as amended by Law Decree 34/144 - the so-called “Jobs Act” - amounted to 4,496, equal to 4,260 FTEs5. Total personnel expenses are up 3.8% from €5,755 million in 2013 to €5,972 million in 2014.

Net finance costs total €108 million (net finance income of €47 million in 2013), reflecting, among other things, the impairment loss recognised on the investment in Alitalia-CAI SpA (€75 million).

Income tax expense is down from the €474 million of 2013 to €216 million for 2014.

The total effective tax rate for 2014 is 79.16%. Compared with the figure for 2013, when the rate was 26.54%, it should be noted that the previous year benefitted from the positive impact of recognition of an IRES refund for the years from 2004 to 2006, in accordance with Law Decree 201 of 6 December 2011 (resulting in a reduction in the tax rate of 22.59%).

In terms of the composition of the tax rate, the effective rates for IRAP and IRES in 2014 are 72.71% and 6.45%, respectively; the significant reduction in the effective tax rate for IRES, compared with the statutory rate of 27.5%, primarily reflects the deductibility (95%) of dividends received from certain subsidiaries.

Profit for 2014 thus amounts to €57 million (€708 million for 2013), despite benefitting from the profit reported by BancoPosta RFC (€440 million), which was unable to offset the losses incurred by the postal business.

(1) This method defines the cost incurred as the difference between the net operating cost incurred by a designated universal service provider when subject to universal service obligations and the net operating cost without such obligations. Application of the method requires a series of assumptions in order to construct the hypothetical postal operator without obligations, on which to base assessment of the related net costs and revenues.

(2) The workforce at 1 January of each year is identical to the workforce at 31 December of the previous year.

(3) Art. 2, paragraph 1-bis of Legislative Decree 368/01 requires, among other things, that fixed-term contracts must not represent more than 15% of a company’s workforce on 1 January of the year in which the staff are recruited.

(4) Art. 1, paragraph 1 of Legislative Decree 368/01, as amended by Law Decree 34/14 (the so-called “Jobs Act”) establishes, among other things, that employees recruited on fixed-term contracts cannot exceed 20% of a company’s permanent workforce at 1 January of the year in which they are recruited, after rounding up to the nearest whole number should the figure be equal to or above 0.5.

(5) The number of fixed-term contracts – expressed in terms of both headcount and FTEs – includes, for 2014, both contracts and renewals during the year in question. In fact, given that Law Decree 34/14 came into force on 21 March 2014, there were no contracts in effect at 1 January of that year previously executed in accordance with the Jobs Act.