Highlights

Group results

Profit for the first half of 2016 amounts to €565 million, an improvement of €130 million on the same period of 2015.

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

| for the six months ended 30 June (€m) | 2016 | 2015 | Increase/(decrease) | |

|---|---|---|---|---|

| Revenue from sales and services and insurance premium revenue | 14,867 | 13,864 | 1,003 | 7.2% |

| Postal and Business Services | 1,855 | 1,906 | (51) | -2.7% |

| Financial Services | 2,315 | 2,341 | (26) | -1.1% |

| Insurance Services and Asset Management | 10,583 | 9,495 | 1,088 | 11.5% |

| Other Services | 114 | 122 | (8) | -6.6% |

| Other income from financial and insurance activities | 2,781 | 2,055 | 726 | 35.3% |

| Financial Services | 512 | 320 | 192 | 60.0% |

| Insurance Services and Asset Management | 2,269 | 1,735 | 534 | 30.8% |

| Other operating income | 34 | 31 | 3 | 9.7% |

| Postal and Business Services | 29 | 27 | 2 | 7.4% |

| Financial Services | 3 | 3 | - | n/s |

| Insurance Services and Asset Management | 2 | - | 2 | n/s |

| Other Services | - | 1 | (1) | n/s |

| Total revenue | 17,682 | 15,950 | 1,732 | 10.9% |

| Cost of goods and services | 1,215 | 1,239 | (24) | -1.9% |

| Net change in technical provisions for insurance business and other claims expenses | 11,944 | 10,385 | 1,559 | 15.0% |

| Other expenses from financial and insurance activities | 309 | 305 | 4 | 1.3% |

| Personnel expenses | 2,985 | 2,983 | 2 | 0.1% |

| Capitalised costs and expenses | (8) | (12) | 4 | -33.3% |

| Other operating costs | 95 | 123 | (28) | -22.8% |

| Total costs | 16,540 | 15,023 | 1,517 | 10.1% |

| EBITDA | 1,142 | 927 | 215 | 23.2% |

| Depreciation, amortisation and impairments | 299 | 289 | 10 | 3.5% |

| Operating profit/(loss) | 843 | 638 | 205 | 32.1% |

| Finance income/(costs) | 9 | 27 | (18) | -66.7% |

| Profit/(loss) on investments accounted for using the equity method | 6 | - | 6 | n/s |

| Profit/(Loss) before tax | 858 | 665 | 193 | 29.0% |

| Income tax expense | 293 | 230 | 63 | 27.4% |

| Profit for the period | 565 | 435 | 130 | 29.9% |

n.s.: not significant

Operating profit is up 32.1% from €638 million for the first half of 2015 to €843 million for the first six months of 2016, benefitting from the positive performances of all the Group operating segments.

The Postal and Business Services segment made a positive contribution of €74 million to operating profit (an operating loss of €89 million in the same period of the previous year), essentially reflecting the positive contribution from the fees paid by BancoPosta RFC in return for use of the Group’s distribution network.

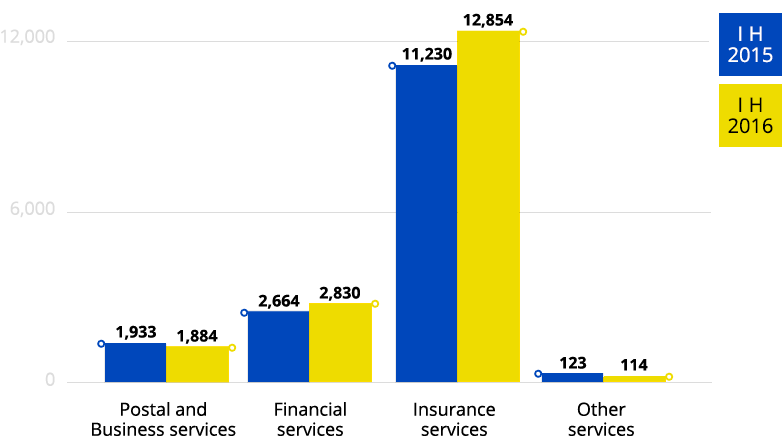

GROUP - REVENUE BY OPERATING SEGMENT

(DATA IN MILLIONS OF EURO)

Total revenue of €17.7 billion is up 10.9% on the same period of 2015. The improvement primarily reflects the positive performance of insurance services and asset management, where total revenue amounts to €12.9 billion (up 14.5% on the first half of 2015).

- Postal and Business Services: contributed total revenue €1,884 million, registering a reduction of 2.5% (€1,933 million in the first half of 2015) due to the expected decline in traditional letter post. It should be noted that there has been an ongoing slowdown in the pace of decline in this segment’s total revenue over a number of quarters. This reflects the partial replacement of revenue from traditional letter post with revenue from the parcels business.

- Financial Services: total revenue from Financial Services amounts to €2,830 million, marking an increase of 6.2% due to a rise in “Other income from financial activities”, which is up from €320 million in the first half of 2015 to €512 million in the same period of 2016. This income includes €121 million in non-recurring income generated by the sale of the Group’s investment in Visa Europe Ltd.

- Insurance Services: the Insurance Services and Asset Management segment which, from 1 January 2016, also includes the activities of BancoPosta Fondi Sgr, delivered excellent results during the period, with Poste Vita and its subsidiary, Poste Assicura, recording premium revenue of €10.6 billion (premium revenue of €9.5 billion in the same period of 2015). This primarily reflects the performances of traditional Class I investment and savings products, where the Group has built up a strong presence.

- Other Services: total revenue from Other Services amounts to €114 million (€123 million in the same period of 2015) and is generated by Poste Mobile..