Profit for the first quarter of 2016 amounts to €367 million, an improvement of €56 million on the same period of 2015.

Operating profit is up 16.1% from €484 million for the first quarter of 2015 to €562 million for the first three months of 2016, benefitting from the positive performances of almost all the sectors in which the Group operates.

RECLASSIFIED CONSOLIDATED STATEMENT OF PROFIT OR LOSS

| for the three months ended 31 March | Increase/(decrease) | |||

|---|---|---|---|---|

| (€m) | 2016 | 2015 | Values | % |

| Revenue from sales and services and insurance premium revenue | 8,277 | 7,142 | 1,135 | 15.9% |

| Postal and Business Services | 923 | 969 | (46) | -4.7% |

| Financial Services | 1,165 | 1,178 | (13) | -1.1% |

| Insurance Services and Asset Management | 6,132 | 4,931 | 1,201 | 24.4% |

| Other Services | 57 | 64 | (7) | -10.9% |

| Other income from financial and insurance activities | 1,467 | 1,385 | 82 | 5.9% |

| Financial Services | 389 | 317 | 72 | 22.7% |

| Insurance Services and Asset Management | 1,078 | 1,068 | 10 | 0.9% |

| Other operating income | 15 | 16 | (1) | -6.3% |

| Postal and Business Services | 13 | 14 | (1) | -7.1% |

| Financial Services | 2 | 2 | - | n/s |

| Total revenue | 9,759 | 8,543 | 1,216 | 14.2% |

| Cost of goods and services | 600 | 617 | (17) | -2.8% |

| Net change in technical provisions for insurance business and other claims expenses | 6,728 | 5,734 | 994 | 17.3% |

| Other expenses from financial and insurance activities | 197 | 15 | 182 | n/s |

| Personnel expenses | 1,505 | 1,498 | 7 | 0.5% |

| Capitalised costs and expenses | (4) | (5) | 1 | -20.0% |

| Other operating costs | 20 | 55 | (35) | -63.6% |

| Total costs | 9,046 | 7,914 | 1,132 | 14.3% |

| EBITDA | 713 | 629 | 84 | 13.4% |

| Depreciation, amortisation and impairments | 151 | 145 | 6 | 4.1% |

| Operating profit/(loss) | 562 | 484 | 78 | 16.1% |

| Finance income/(costs) | 3 | 2 | 1 | 50.0% |

| Profit/(loss) on investments accounted for using the equity method | 3 | - | 3 | n/s |

| Profit/(Loss) before tax | 568 | 486 | 82 | 16.9% |

| Income tax expense | 201 | 175 | 26 | 14.9% |

| Profit for the period | 367 | 311 | 56 | 18.0% |

n/s: not significant

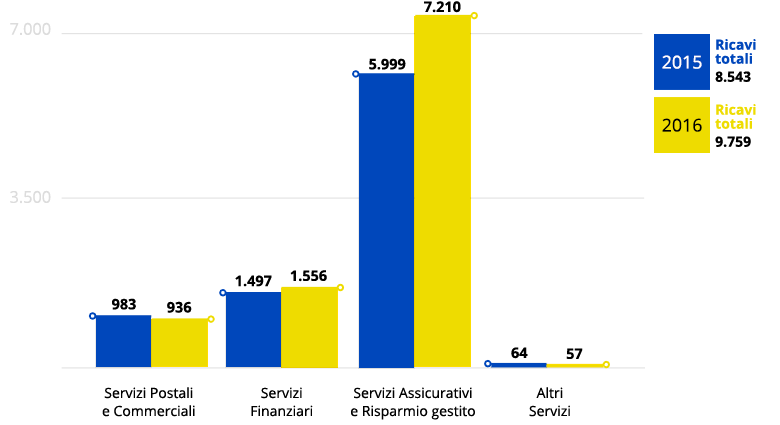

Group - Total revenue by operating segment

(DATA IN MILLION EURO)

Total revenue of €9,759 million is up 14.2% on the same period of 2015.

- Postal and Business Services: contributed total revenue €936 million, registering a reduction of 4.8% (€983 million in the first quarter of 2015) due to the expected decline in traditional letter post.

- Financial Services: total revenue amounts to €1,556 million, marking an increase of 3.9% due to a rise in “Other income from financial activities”, which is up from €317 million in the first quarter of 2015 to €389 million in the same period of 2016. This income is primarily generated by the sale of available-for-sale financial assets, in which the postal current account deposits of BancoPosta RFC’s private customers are invested.

- Insurance Services: the segment which, from 1 January 2016, also includes the activities of BancoPosta Fondi Sgr, delivered excellent results during the period, with Poste Vita and its subsidiary, Poste Assicura, recording premium revenue of €6.1 billion (premium revenue of €4.9 billion in the same period of 2015). This primarily reflects the performances of traditional Class I investment and savings products, where the Group has built up a strong presence. Other income from financial and insurance activities is up €10 million from €1,068 million in the first quarter of 2015 to €1,078 million in the same period of 2016.

- Other Services: total revenue amounts to €57 million (€64 million in the same period of 2015) and is generated by Poste Mobile.