The Group saw a significant improvement in its operating performance in 2015, with operating profit of €880 million up 27% on 2014 (€691 million in 2014) and profit for the year of €552 million (€212 million in 2014).

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

| for the year ended 31 December | Increase/(decrease) | |||

|---|---|---|---|---|

| (€m) | 2015 | 2014 | Amount | % |

| Revenue from sales and services and insurance premium revenue | 27,007 | 24,622 | 2,385 | 9.7% |

| Postal and Business Services | 3,825 | 3,964 | (139) | -3.5% |

| Financial Services | 4,744 | 4,950 | (206) | -4.2% |

| Insurance Services (*) | 18,199 | 15,472 | 2,727 | 17.6% |

| Other Services | 239 | 236 | 3 | 1.3% |

| Other income from financial and insurance activities | 3,657 | 3,772 | (115) | -3.0% |

| Financial Services | 442 | 404 | 38 | 9.4% |

| Insurance Services | 3,215 | 3,368 | (153) | -4.5% |

| Other operating income | 75 | 118 | (43) | -36.4% |

| Postal and Business Services | 68 | 110 | (42) | -38.2% |

| Financial Services | 2 | 4 | (2) | -50.0% |

| Insurance Services | 1 | - | 1 | n/s |

| Other Services | 4 | 4 | - | n/s |

| Total revenue | 30,739 | 28,512 | 2,227 | 7.8% |

| Cost of goods and services | 2,590 | 2,648 | (58) | -2.2% |

| Net change in technical provisions for insurance business and other claims expenses | 19,683 | 17,883 | 1,800 | 10.1% |

| Other expenses from financial and insurance activities | 689 | 76 | 613 | n/s |

| Personnel expenses | 6,151 | 6,229 | (78) | -1.3% |

| Capitalised costs and expenses | (33) | (30) | (3) | 10.0% |

| Other operating costs | 198 | 344 | (146) | -42.4% |

| Total costs | 29,278 | 27,150 | 2,128 | 7.8% |

| EBITDA | 1,461 | 1,362 | 99 | 7.3% |

| Depreciation, amortisation and impairments | 581 | 671 | (90) | -13.4% |

| Operating profit/(loss) | 880 | 691 | 189 | 27.4% |

| Finance income/(costs) | 50 | 7 | 43 | n/s |

| Profit/(loss) on investments accounted for using the equity method | 3 | (1) | 4 | n/s |

| Profit/(Loss) before tax | 933 | 697 | 236 | 33.9% |

| Income tax expense | 381 | 485 | (104) | -21.4% |

| Profit for the year | 552 | 212 | 340 | n/s |

n/s: not significant

(*) This item includes €18,197 million in insurance premiums and €2 million in revenue attributable to the SDS group, in which Poste Vita SpA acquired a controlling interest in 2015.

The contribution to operating profit from Financial Services is up 21% (€930 million in 2015, compared with €766 million in 2014). The Insurance Services segment recorded an excellent operating performance, with Poste Vita registering premium revenue of €18.2 billion (€15.5 billion in premium revenue in the previous year).

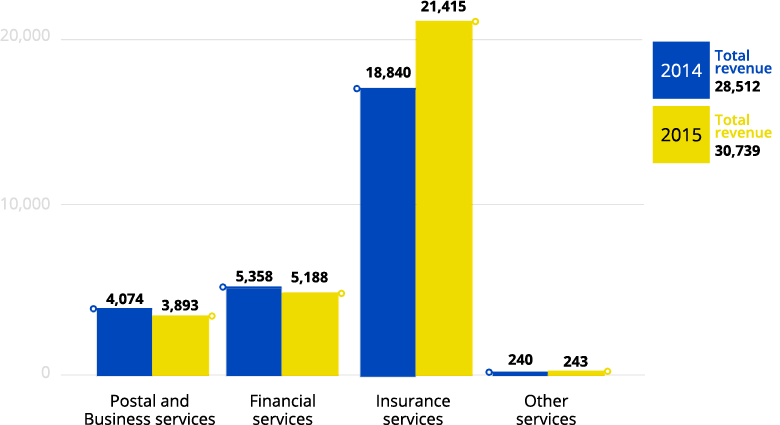

GROUP – TOTAL REVENUE BY OPERATING SEGMENT

(DATA IN MILLION EURO)

The Poste Italiane Group’s total revenue for the year amounts to €30,739 million, marking an increase of 7.8% on 2014.

-

Postal and Business Services: the growing popularity of digital media and communication has led to a progressive reduction in demand for traditional products and services, the operating performance has, for the first time in many years, seen a slowdown in the pace of decline in total revenue, which is down from the €4,074 million of 2014 to €3,893 million in 2015 (a reduction in revenue of €181 million compared with 2014, whilst the reduction in 2014, compared with the previous year, was €378 million).

-

Financial Services: total revenue amounts to €5,188 million, marking a reduction of 3.2%. This reflects the reduction in average interest rates on deposits invested in securities and on deposits with the Ministry of the Economy and Finance, in line with market trends, as well as a decrease in income from the distribution of postal savings products on behalf of Cassa Depositi e Prestiti SpA, linked to the agreed mechanism tying fees to the achievement of net savings inflow targets. The impact of the above was only partially offset by the positive performance of other income from financial activities, which is up from €404 million in 2014 to €442 million in 2015. This was primarily generated by the sale of available-for-sale financial assets, in the form of euro area government securities or, up to a maximum of 50%, of securities guaranteed by the Italian government8, in which the postal current account deposits of BancoPosta RFC’s private customers are invested.

-

Insurance Services: the segment delivered excellent results during the period, with Group companies (represented by Poste Vita and its subsidiary, Poste Assicura) recording premium revenue of €18.2 billion (premium revenue of €15.5 billion in 2014). This primarily reflects the performances of traditional Class I investment and savings products, where the Group has built up a strong presence. Other income from financial and insurance activities is, however, down from the €3,368 million of 2014 to €3,215 million in 2015, reflecting fair value losses on the financial instruments held to cover obligations to policyholders.

-

Other Services: total revenue is up €3 million (€243 million in 2015, compared with €240 million in 2014). This reflects improved operating results from Poste Mobile, making an important contribution to the Group’s operating result.