During a year in which the economic environment remained challenging, the overall results of the Poste Italiane Group and its Parent Company reflect positive performances from financial and insurance services, offset by a further decline in traditional postal services, which recorded a progressive reduction in revenue, weighing heavily on the results for the year.

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

| Increase/(decrease) | Year ended 31 December | |||

|---|---|---|---|---|

| (€m) | % | Amount | 2013 | 2014 |

| Revenue from sales and services | (4.9) | (472) | 9,622 | 9,150 |

| Insurance premium revenue | 17.2 | 2,272 | 13,200 | 15,472 |

| Other income from financial and insurance activities | 15.0 | 491 | 3,281 | 3,772 |

| Other operating income | (28.5) | (47) | 165 | 118 |

| Total revenue | 8.5 | 2,244 | 26,268 | 28,512 |

| Cost of goods and services | (3.1) | (86) | 2,734 | 2,648 |

| Net change in technical provisions for insurance business and other claims expenses | 17.1 | 2,617 | 15,266 | 17,883 |

| Other expenses from financial and insurance activities | 2.7 | 2 | 74 | 76 |

| Personnel expenses | 3.7 | 221 | 6,008 | 6,229 |

| Depreciation, amortisation and impairments | 13.9 | 82 | 589 | 671 |

| Capitalised costs and expenses | (47.4) | 27 | (57) | (30) |

| Other operating costs | 35.4 | 90 | 254 | 344 |

| Total ope rating costs | 11.9 | 2,953 | 24,868 | 27, 821 |

| OPERATING PROFIT/(LOSS) | (50.6) | (709) | 1,400 | 691 |

| Finance income | (12.4) | (28) | 226 | 198 |

| Finance costs | 94.9 | 93 | 98 | 191 |

| Profit/(loss) on investments accounted for using the equity method | n/s | (1) | - | (1) |

| PROFIT/(LOSS) BEFORE TAX | (54.4) | (831) | 1,528 | 697 |

| Income tax expense | (35.0) | (261) | 746 | 485 |

| Income tax for previous years following change in legislation | n/s | 223 | (223) | - |

| PROFIT FOR THE YEAR | (78.9) | (793) | 1,005 | 212 |

n/a: not applicable

n/s: not significant

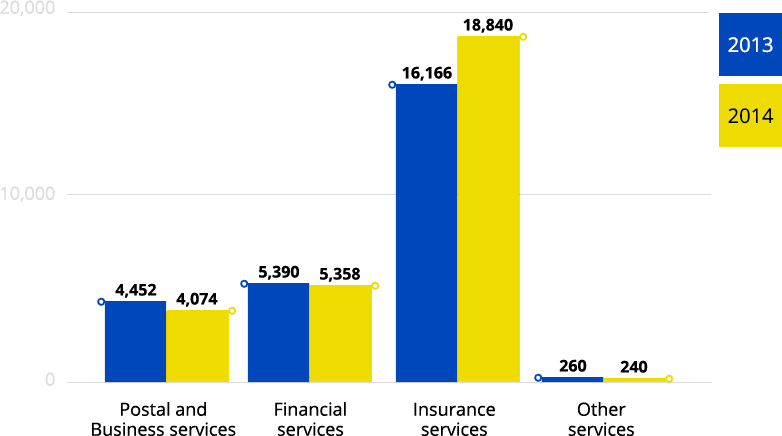

In particular, the Group’s operating profit amounts to €691 million (€1,400 million for 2013), whilst the Parent Company reports a figure of €381million (€917 million for the previous year), reflecting, as already noted, the decline in revenue from Postal and Business services, which is down from the €4,452 million of 2013 to €4,074 million in 2014.

GROUP – TOTAL REVENUE BY OPERATING SEGMENT (DATA IN MILLION EURO)

Group’s total revenue of €28,512 million (€26,268 million in 2013) benefitted from the positive contribution from Poste Vita’s premium revenue.

- Postal and Business services: total revenue is down 8.5% (a reduction of €378 million) and continues to suffer from the crisis in traditional forms of communication, reflecting the growing popularity of digital technologies, and the general reduction in demand for products and services, exacerbated by tough price competition.

- Financial services: total revenue, amounting to €5,358 million, is in line with the previous year (down 0.6% on 2013), having benefitted from the positive performance of other income from financial activities.

- Insurance services: the Insurance services provided by the Poste Vita Group have contributed €18,840 million to total revenue, marking growth of 16.5% on the €16,166 million of the previous year.

- Other services: total revenue amounts to €240 million (€260 million in the previous year) and regards the revenue generated by the mobile telecommunications services provided by PosteMobile SpA and Consorzio per I servizi di telefonia Mobile ScpA.