Operating profit for the first nine months of 2017 amounts to €1,176 million, slightly down on the figure for the same period of the previous year (€1,196 million in the first nine months of 2016).

CONSOLIDATED STATEMENT OF PROFIT AND LOSS AS OF 30 SEPTEMBER 2017

| for the nine months ended 30 September | ||||

|---|---|---|---|---|

| 2017 | 2016 | Increase/(decrease) | ||

| Postal and Business Services | 2,660 | 2,728 | (68) | -2.5% |

| Financial Services | 3,981 | 4,107 | (126) | -3.1% |

| Insurance Services and Asset Management | 19,458 | 18,725 | 733 | 3.9% |

| Other Services | 154 | 169 | (15) | -8.9% |

| Total revenue | 26,253 | 25,729 | 524 | 2.0% |

| Cost of goods and services | 1,765 | 1,809 | (44) | -2.4% |

| Net change in technical provisions for insurance business and other claims expenses | 17,916 | 17,449 | 467 | 2.7% |

| Other expenses from financial and insurance activities | 468 | 360 | 108 | 30.0% |

| Personnel expenses | 4,241 | 4,333 | (92) | -2.1% |

| Capitalised costs and expenses | (18) | (15) | (3) | 20.0% |

| Other operating costs | 292 | 158 | 134 | 84.8% |

| Total costs | 24,664 | 24,094 | 570 | 2.4% |

| EBITDA | 1,589 | 1,635 | (46) | -2.8% |

| Depreciation, amortisation and impairments | 413 | 439 | (26) | -5.9% |

| Operating profit/(loss) | 1,176 | 1,196 | (20) | -1.7% |

| Finance income/(costs) | (81) | 14 | (95) | n/s |

| Profit/(loss) on investments accounted for using the equity method | 12 | 7 | 5 | 71.4% |

| Profit/(Loss) before tax | 1,107 | 1,217 | (110) | -9.0% |

| Income tax expense | 383 | 410 | (27) | -6.6% |

| Profit for the period | 724 | 807 | (83) | -10.3% |

n.s.: non significativo

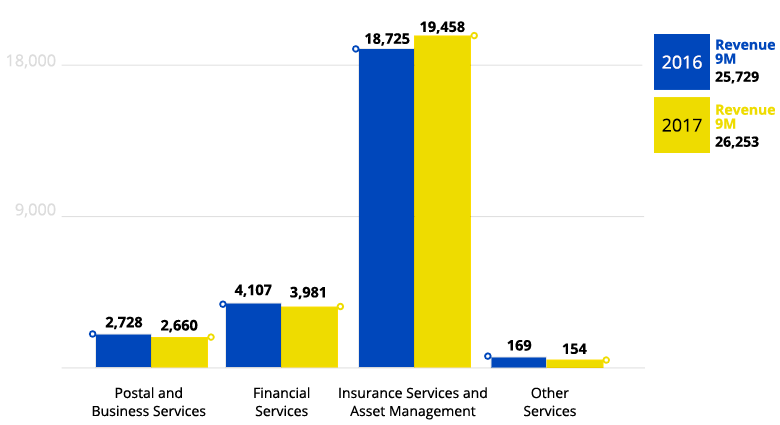

Total revenue by operating segment for the nine months ended 30 September

(€M)

Total revenue of €26.3 billion is up 2% on the first nine months of 2016, primarily due to the previously mentioned positive performance of insurance services and asset management.

- Postal and Business Services: contributed total revenue of €2,660 million, registering a reduction of 2.5% compared with the first nine months of 2016, due to a decline in traditional letter post, which is down 10.3% from 2,590 million items in the first nine months of 2016 to 2,324 million. Express Delivery and Parcel services continued to perform well, with volumes up 19.1% from 68 million items handled (corresponding to revenue of €461 million) in the first nine months of 2016 to 81 million items handled (corresponding to revenue of €502 million).

- Financial Services: total revenue from Financial Services is down 3.1% from €4,107 million in the first nine months of 2016 to €3,981 million. As mentioned above, the figure for the comparative period benefitted from non-recurring income of €121 million, following the sale of the investment in Visa Europe Ltd.. After adjusting for this item, revenue for the two periods is in line..

- Insurance Services: contributed €19.5 billion to total revenue (€18.7 billion in the same period of the previous year), with premium revenue amounting to €16.4 billion (premium revenue of €15.4 billion in the same period of 2016). This represents a good performance for the period, given the decline in the Life market compared with the positive performance of 2016 (market data for new business to August 2017 shows a contraction of approximately 8% at national level).

- Other Services: total revenue, provided by PosteMobile, amounts to €154 million (€169 million in the same period of 2016). This marks a reduction due to a decline in mobile service revenue, reflecting tough competition in the market.